On Wednesday, the government decided to raise import duties of 19 categories of items in an attempt to curb imports that would help in bridging the widening current account deficit and reduce pressure on the rupee

New Delhi: The Indian rupee strengthened against the US dollar after the government increased tariffs on imported goods to narrow current account deficit. At 9.15am, the rupee was trading at 72.40 a dollar, up 0.30% from its Wednesday’s close of 72.62. The home currency opened at 72.41 per dollar. The 10-year gilt yield stood at 8.04%, below its previous close of 8.072%. Bond yields and prices move in opposite directions

On Wednesday, the government decided to raise import duties of 19 categories of items in an attempt to curb imports that would help in bridging the widening current account deficit and reduce pressure on the rupee.

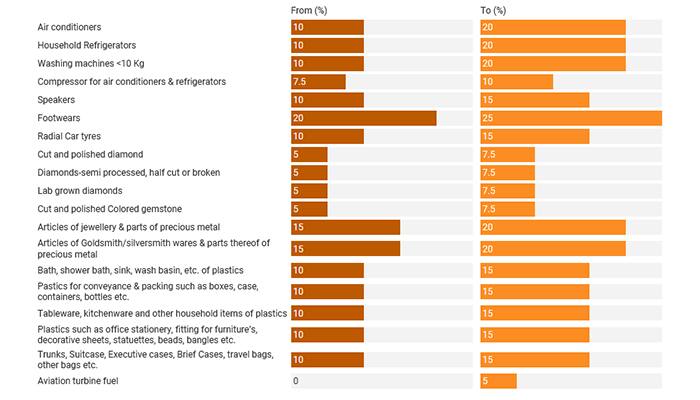

The list includes white goods such as air-conditioners, refrigerators and washing machines as well as non-essential items such as gems, travel bags and aviation turbine fuel (ATF).

According to a Finance ministry note, the increase in rates of basic customs duty is already in effective from midnight today. The total value of imports of these items in 2017-18 was about Rs 86,000 crore.

A higher oil import bill along with strong growth in non-oil non-gold imports have led to a wider trade deficit for India. While export growth has picked up in recent months, it has remained below the rate of growth of imports, leading to a widening of the trade gap.

Import duty on air conditioners, refrigerators and washing machines under 10-kilogram capacity has been doubled to 20% each from 10% earlier. The basic customs duty on radial tyres has been raised to 15% from 10% earlier, while the levy has been hiked to 25% from 10% on footwear. The government also introduced an import levy of 5% on the aviation turbine fuel.

Here’s the full list of items on which tariffs have been increased:

Possible effects

All experts do not agree that import curbs will help in reducing the current account deficit or break the fall in the Indian currency.

According to a BloombergQuint report , the effects could be inflationary.

Soumyakanti Ghosh, chief economic adviser at SBI, said: “The impact of these import duty hikes would be less than 10 basis points on the current account deficit. This would improve sentiments only in the short term.”

Ajay Dua, former secretary of the Department of Industrial Promotion and Policy, suggested that the government could consider increasing its revenue collections by increasing duty on some high-value items like gold, high-end mobile phones and even thermal coal which India has been importing in large quantities.

Earlier, the Reserve Bank of India had eased rules to maintain the liquidity coverage ratio. RBI increases ability of banks to avail liquidity from the repo markets against high-quality collateral. “Going forward, the Reserve Bank stands ready to meet the durable liquidity requirements of the system through various available instruments depending on its dynamic assessment of the evolving liquidity and market conditions”, RBI said in a note.

(with agency inputs)

Last Updated Sep 27, 2018, 11:11 AM IST

![Salman Khan sets stage on fire for Anant Ambani, Radhika Merchant pre-wedding festivities [WATCH] ATG](https://static-gi.asianetnews.com/images/01hr1hh8y86gvb4kbqgnyhc0w0/whatsapp-image-2024-03-03-at-12-24-37-pm_100x60xt.jpg)

![Pregnant Deepika Padukone dances with Ranveer Singh at Anant Ambani, Radhika Merchant pre-wedding bash [WATCH] ATG](https://static-gi.asianetnews.com/images/01hr1ffyd3nzqzgm6ba0k87vr8/whatsapp-image-2024-03-03-at-11-45-35-am_100x60xt.jpg)