Owing to the excellent track record of inflation targeting by the RBI that coincided with the Narendra Modi regime, extra caution is no longer warranted to keep prices under check. hence, the central bank has decided to ease the repo rate further. Here are the other policy measures that are bound to improve conditions of the Indian market.

New Delhi: During its sixth bi-monthly monetary policy review of the ongoing fiscal, the RBI had cut key-term lending (repo) rate by 25bps to 6.25%. This recent move is expected to make home and other loans cheaper.

What is repo rate?

The repo rate can be defined as the rate at which short-term money is lent out to the banks by the RBI. Now that the repo rate is cut, banks can extend this benefit to the customers. That is, it makes businesses easier as traders borrow money from banks at a lower rate of interest.

"Turning to the growth outlook, GDP growth for 2018-19 in the December policy was projected at 7.4% (7.2-7.3% in H2) and at 7.5% for H1:2019-20, with risks somewhat to the downside,” said the RBI in a statement.

A reduced repo rate can also boost investment activities in the economy.

Other takeaways

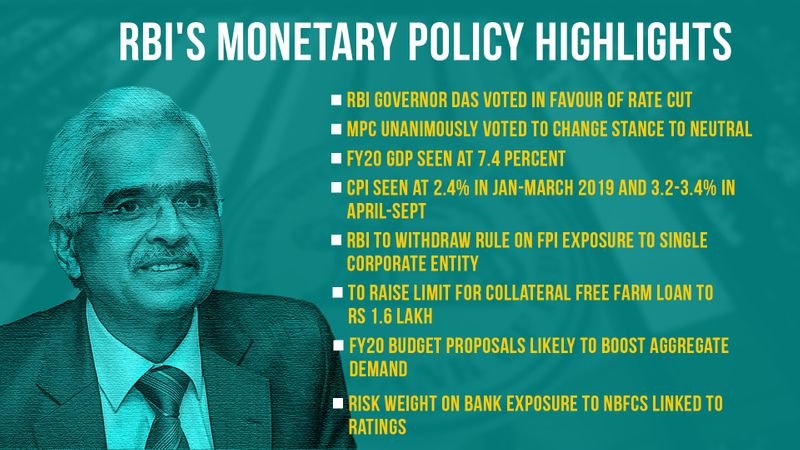

1. While addressing the media on Thursday, RBI governor Shaktikanta Das revealed other policy measures adopted by the central bank to boost the economy.

2. Das changed the monetary policy stance from ‘calibrated tightening’ to ‘neutral’ on low inflation footprint. Remember, inflation has been on a tight leash under the Narendra Modi government and, hence, extra caution that Das's predecessors were exercising is no longer warranted.

3. Headline inflation had fallen to an 18-month low of 2.2% in December, which led the RBI to cut its estimates for the next year. The central bank expects headline inflation numbers to come down to 2.8% in March quarter, 3.2-3.4% in the first half of the next fiscal and 3.9% in third quarter (July-September) of FY20. This means that commodities will continue to be priced reasonably for us, consumers. In the meantime, budget proposals announced by finance minister Piyush Goyal on February 1 are expected to raise the middle class's purchasing power and, thus, enhance demand in the ,arket, but this will play out gradually.

4. The GDP is expected to grow at a rate of 7.4% in FY20, said the RBI. In FY19 the CSO estimated the GDP growth rate to be 7.2%. This is bound to address the issue of the perceived joblessness. If the economy is growing rapidly, there must be manpower that is serving the added size of the economy.

5. The RBI, in a bid to help small farmers, raised the limit of collateral-free agricultural loans to Rs 1.6 lakh from the current Rs 1 lakh. This implies that farmers under distress will not be strained further by difficult terms of mortgage and borrowing.

6. The RBI will review agricultural credit and figure out a workable policy solution. The central bank decided to set up an internal working group (IWG). That means that the last word on farm benefit has not been said. Farmers will continue to enjoy state support.

7. RBI said, “This enhancement Rs 60,000 has been taken in view of the overall rise in inflation, marginal agriculture input and benefit to small farmers.”