Conventional financial avenues often come across as bureaucratic, prompting a growing number of entrepreneurs to explore funding options like crowdfunding and peer-to-peer (P2P) lending.

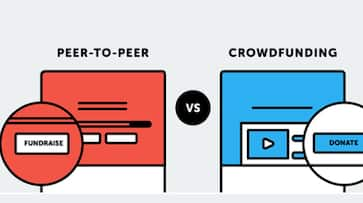

For businesses and startups, acquiring sufficient capital to sustain operations smoothly can pose a significant challenge. Conventional financial avenues often come across as bureaucratic, prompting a growing number of entrepreneurs to explore funding options like crowdfunding and peer-to-peer (P2P) lending. These methods not only offer the flexibility and accessibility lacking in conventional channels but also create direct connections between businesses and a diverse pool of investors.

Understanding Crowdfunding

To understand this, think of a group of individuals, each contributing a sum to support the launch of a business—that's essentially what crowdfunding entails. It leverages the strength of friends, family members, customers and individual investors, primarily facilitated through online platforms and social media.

This approach essentially democratises funding by allowing contributions from sources ranging from acquaintances and relatives to strangers towards a business’s financial objectives.

Crowdfunding is appealing because it allows business owners to bypass traditional lending institutions and connect directly with potential backers and customers. There are various types of crowdfunding options for working capital management, each serving specific strategic purposes for businesses.

Rewards-based crowdfunding offers backers incentives or products in exchange for their support. Nonprofits and community projects often use donation-based crowdfunding, where contributors give without expecting anything in return. Equity-based crowdfunding, on the other hand, allows people to invest in a company in exchange for ownership shares, making it an appealing option for startups looking for funding without taking on debt.

Another approach is debt-based crowdfunding, also known as peer-to-peer lending. In this model, individuals lend money with the promise of repayment plus interest, providing an alternative to traditional loans.

For example, imagine a café looking to open in a neighbourhood. Through rewards-based crowdfunding, the café could offer coffee subscriptions or exclusive experiences to raise funds and build community excitement. This pre-launch engagement not only secures capital but also fosters market validation and community support, which are crucial for the success of any new business.

Exploring Peer-to-Peer (P2P) Lending

P2P lending is like a digital marketplace where individuals seeking money can connect with those wanting to invest. This method bypasses traditional financial intermediaries like banks, often resulting in quicker and more flexible loan arrangements for small businesses.

The appeal of P2P lending lies in its ability to offer lower interest rates compared to traditional loans, primarily due to reduced overhead costs from operating online rather than having physical branches. Additionally, the application process on P2P platforms is usually quicker and less cumbersome, often requiring fewer documents and providing faster approval. This speed and efficiency are crucial for small businesses that need timely access to funds to manage operations or seize market opportunities.

P2P platforms often have more lenient eligibility criteria, making them accessible to many small businesses and startups that may not have extensive financial histories or high credit scores typically required by traditional lenders. This inclusivity expands the opportunity for financial support, which is crucial for fostering entrepreneurship and innovation in the economy.

A practical example of how P2P lending supports small businesses is a small manufacturer in need of immediate funds to purchase raw materials. By using a P2P lending platform, the manufacturer can access capital from a diverse group of investors. This not only quickly secures the needed funds but also diversifies the risk among multiple investors. This flexibility and quick access to funds make P2P lending a compelling choice for businesses looking for alternatives to traditional financing routes.

Benefits of Crowdfunding and P2P Lending for Working Capital

These alternative financing routes are more than just a lifeline for businesses in tight spots. They offer significant advantages that can support and even enhance business operations.

-

Flexible Use of Funds: The money raised through crowdfunding or P2P lending isn't tied to specific assets or purposes—you can use it as you see fit to cover any business expenses.

-

Widening Your Financial Reach: These platforms connect you with investors beyond your local lender or usual contacts, potentially offering access to a global pool of funds.

-

Building Your Business Community: Especially with crowdfunding, you're not just raising money; you're engaging with your market, validating your business idea, and building a group of supporters who have a vested interest in your success.

-

Speed of Funding: Both crowdfunding and P2P lending can offer much faster access to funds compared to traditional routes. This speed can be crucial for businesses that need to act quickly to seize opportunities or address unforeseen challenges.

-

Cost-Effectiveness: Generally, these platforms have lower fees and interest rates compared to traditional financial products. This can make a significant difference in the total cost of finance for businesses operating with thin margins.

-

Enhanced Transparency: Crowdfunding and P2P platforms often offer greater transparency regarding costs and terms, allowing for better planning and management of financial obligations.

-

Credit Flexibility: For businesses that may not qualify for traditional loans due to lack of collateral or less-than-perfect credit scores, P2P lending offers an alternative with more flexible credit requirements, often based on the overall health and potential of the business rather than just a credit score.

Regulatory Compliance in Crowdfunding and P2P Lending

When using crowdfunding and P2P lending platforms, it's essential to understand and follow regulatory requirements. Both methods are subject to legal frameworks that vary by country and are designed to protect both investors and borrowers.

For example, these platforms must ensure that all participants are informed about the potential risks and rewards. Businesses are also required to provide transparent and accurate information about their financial status and how the funds will be used.

Compliance with these regulations not only ensures the legality of the funding process but also builds trust with potential investors. For businesses, this means working closely with platform operators to ensure that all information is compliant and current, helping to prevent legal issues and create a trustworthy investment environment.

Conclusion

As traditional funding becomes more challenging, especially for SMEs, alternative financing methods like crowdfunding and P2P lending offer valuable opportunities. These approaches not only address working capital needs but also foster community engagement and market validation. For entrepreneurs struggling with cash flow, these innovative platforms provide practical and accessible solutions to keep their businesses thriving.

Last Updated Aug 21, 2024, 1:21 PM IST

![Salman Khan sets stage on fire for Anant Ambani, Radhika Merchant pre-wedding festivities [WATCH] ATG](https://static-gi.asianetnews.com/images/01hr1hh8y86gvb4kbqgnyhc0w0/whatsapp-image-2024-03-03-at-12-24-37-pm_100x60xt.jpg)

![Pregnant Deepika Padukone dances with Ranveer Singh at Anant Ambani, Radhika Merchant pre-wedding bash [WATCH] ATG](https://static-gi.asianetnews.com/images/01hr1ffyd3nzqzgm6ba0k87vr8/whatsapp-image-2024-03-03-at-11-45-35-am_100x60xt.jpg)